(877) 806-8728

We'll focus on your home's energy efficiency, so you can focus on what matters most.

Elevate Insulations' Services

100% Satisfaction Guarantee: Our technicians have received specialized training to properly install your quality products to help you notice a difference. Everything will be done up to your satisfaction and we will redo areas in need until they are done correctly to make a difference. We strive to make sure all work is performed to the highest standard.

Click on the images to learn more!

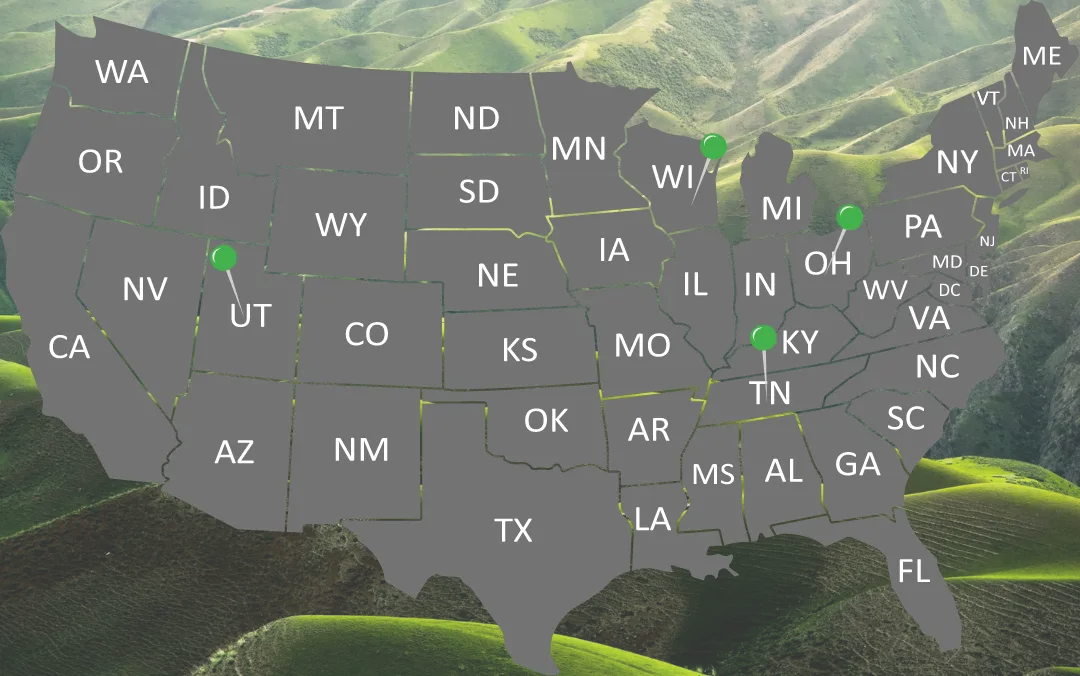

Our Service Areas

We are currently servicing the following areas:

Call for pricing (877) 806-8728

Advantages for Elevating Energy Efficiency

Tax credits and rebates are available for increasing your energy efficiency! Reach out to see if your home qualifies.

Our Results Speak for Themselves

"This company went above and beyond for the work that was performed at my home. The employees were friendly and professional. Elevate is the only company I would recommend for attic insulating jobs!"

John Hixenbaugh

"I was very pleased with the professional and efficient way the insulation was installed. All of the people involved were polite and very neat with their work."

Patty Laroe

"Elevate Insulation did a great job. On time, professional, polite and efficient. They got in and got the job done. The crew cleaned up after themselves when it was completed. I would definitely recommend them."

Jim Pezzot

"This company went above and beyond for the work that was performed at my home. The employees were friendly and professional. Elevate is the only company I would recommend for attic insulating jobs!"

Bonnie Lindner

Decrease Your Gas Bill Today: (877) 806-8728

Now Hiring

We are always looking for dedicated individuals to join our team in elevating home efficiency.

For employment opportunities, give us a call today!

Contact Us (877) 806-8728

Copyright © 2024 Elevate Insulation LLC. All rights reserved.